The Pacific Islands Tax Administrators Association (PITAA) represented the Pacific region at the Sixth Meeting of the OECD Global Forum on VAT, with its Head of Secretariat (HoS), Mr. Petero Maivucevuce, attending the meeting in Paris, France, from 26–28 January 2026.

The forum brought together tax officials from more than 100 countries, along with international and regional organisations and selected stakeholders, to exchange policy insights and strengthen international cooperation on Value Added Tax (VAT) and Goods and Services Tax (GST). Discussions focused on global VAT/GST developments, including digital trade and e-commerce, the gig and sharing economy, artificial intelligence in tax administration, e-invoicing, and strategies to mitigate VAT/GST fraud.

Through its participation, PITAA ensured that Pacific perspectives and priorities were represented in global tax policy discussions that influence international VAT/GST standards.

“Global VAT and GST reforms are not abstract policy discussions for the Pacific. They directly affect our revenue sustainability, our ability to manage digital trade, and the capacity of our tax administrations,” Mr. Maivucevuce said.

“Engaging at this level ensured that Pacific realities were understood in global decision-making spaces,” he added.

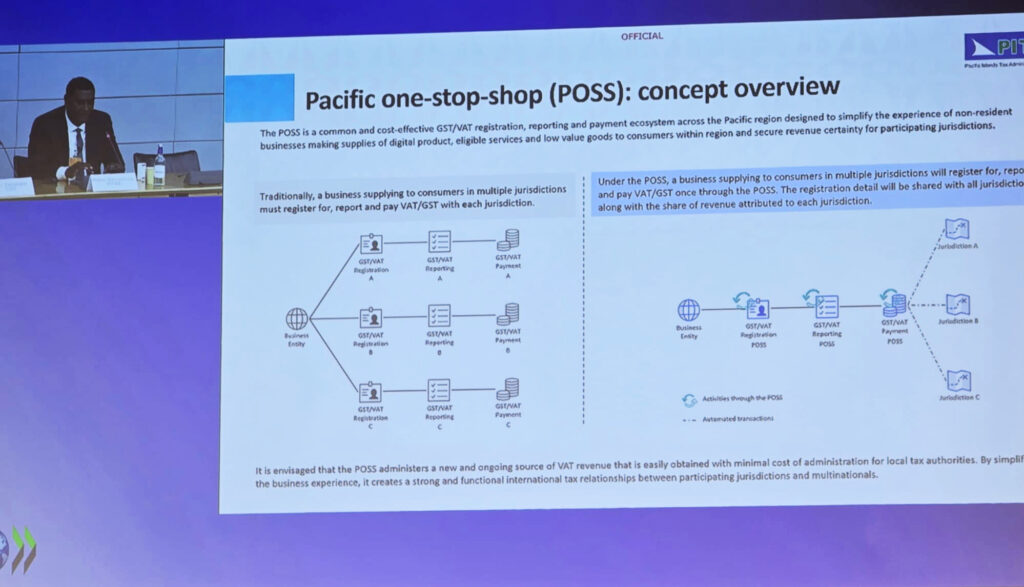

A key highlight of PITAA’s engagement at the Forum was Mr. Maivucevuce’s participation as a speaker in the Plenary Session on “Shaping the Future of VAT/GST: Priorities and Opportunities”. During the session, he shared Pacific experiences and presented the Pacific One-Stop-Shop (POSS) initiative as a regional approach to improving the taxation of cross-border digital supplies.

The Pacific One-Stop-Shop is a simplified VAT/GST registration, reporting, and payment system designed for non-resident businesses supplying digital products and services to Pacific Island countries. Developed with the support of the Australian Government through the Department of Foreign Affairs and Trade (DFAT) and aligned with the OECD International VAT/GST Guidelines, the initiative aims to reduce compliance complexity for businesses while supporting participating jurisdictions to strengthen revenue collection from the digital economy.

The forum also served as a valuable platform for strengthening partnerships and exchanging practical experiences among tax administrations. Mr. Maivucevuce noted that continued collaboration was critical to addressing VAT/GST risks in the digital economy and supporting smaller administrations as tax systems adapt to emerging global challenges.

PITAA’s participation in the Sixth Meeting of the OECD Global Forum on VAT supported its ongoing work to strengthen VAT/GST administration across the Pacific through practical cooperation, policy engagement, and knowledge exchange, while reinforcing the region’s contribution to global tax policy discussions.